Alger Small Cap Focus Fund Class C (VWAGY)

11.98

-0.04 (-0.33%)

OP · Last Trade: Feb 8th, 12:27 PM EST

Detailed Quote

| Previous Close | 12.02 |

|---|---|

| Open | 11.81 |

| Bid | - |

| Ask | - |

| Day's Range | 11.81 - 11.98 |

| 52 Week Range | 9.197 - 12.83 |

| Volume | 110,329 |

| Market Cap | - |

| PE Ratio (TTM) | - |

| EPS (TTM) | - |

| Dividend & Yield | N/A (N/A) |

| 1 Month Average Volume | 122,127 |

Chart

News & Press Releases

There's no denying that the technology being developed is the future. The question is, can this company actually adequately capitalize on this evolution?

Via The Motley Fool · February 8, 2026

Volkswagen has potentially found a way to roll out EVs while mitigating their short-term problems.

Via The Motley Fool · February 7, 2026

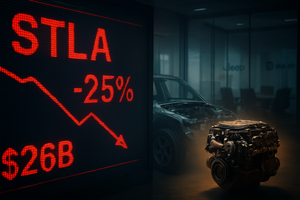

The global automotive landscape was jolted on February 6, 2026, as Stellantis N.V. (NYSE: STLA) saw its shares plummet by 25% following the announcement of a massive €22.2 billion ($26 billion) one-time charge. The staggering write-down is the cornerstone of a radical "business reset" orchestrated by new leadership

Via MarketMinute · February 6, 2026

As the global automotive industry navigates a volatile transition toward electrification, Ford Motor Company (NYSE: F) finds itself at a defining crossroads. The Dearborn-based automaker is scheduled to release its fourth-quarter 2025 financial results on February 10, 2026, with Wall Street analysts laser-focused on a consensus earnings-per-share (EPS) estimate of

Via MarketMinute · February 6, 2026

The geopolitical landscape was rocked in early 2026 by the so-called "Greenland Episode," a diplomatic and economic confrontation that has pushed the relationship between the United States and the European Union to its lowest point in decades. What began as a renewed U.S. strategic interest in the Arctic territory

Via MarketMinute · February 6, 2026

BYD is the top dog in the Chinese auto market, but the world's largest EV market is set for a shock in 2026. Can BYD survive and thrive without help from Beijing?

Via The Motley Fool · February 6, 2026

As the first quarter of 2026 unfolds, the financial markets are navigating a paradoxical landscape defined by aggressive fiscal expansion and unprecedented geopolitical friction. While the "Stampeding Bull" of 2024 and 2025 was driven by a frenzy of price-to-earnings expansion and artificial intelligence (AI) hype, a new narrative has taken

Via MarketMinute · February 6, 2026

On February 6, 2026, the semiconductor landscape witnessed a jarring recalibration as Qualcomm Incorporated (NASDAQ: QCOM) shares plummeted 8.5% in a single trading session. The catalyst for this sharp correction was not a failure of innovation or a loss of market share, but rather a "structural bottleneck" described by management during their Q1 fiscal 2026 [...]

Via Finterra · February 6, 2026

The global economic landscape has been jolted in the opening weeks of 2026 as the United States government formalizes a series of aggressive 25% tariff proposals targeting the critical sectors of semiconductors, automobiles, and pharmaceuticals. These measures, framed as essential for national security and domestic industrial revitalization, have sent shockwaves

Via MarketMinute · February 5, 2026

As of February 5, 2026, Tesla Inc. (NASDAQ: TSLA) finds itself at the most critical juncture in its twenty-year history. Once viewed primarily as a disruptor of the internal combustion engine, the company has spent the last 24 months aggressively shedding its skin as a traditional automaker. Today, Tesla is increasingly valued and analyzed as [...]

Via Finterra · February 5, 2026

Rivian is an innovative EV company making some neat trucks and SUVs, but is it a buy at these prices?

Via The Motley Fool · February 5, 2026

Investors can't even figure out what this company actually is anymore, let alone what it's worth.

Via The Motley Fool · February 4, 2026

There is a good reason why Rivian is a better pick.

Via The Motley Fool · February 4, 2026

Chico, California--(Newsfile Corp. - February 4, 2026) - AmeraMex International, Inc. (OTC Pink: AMMX), a premier provider of new and...

Via Newsfile · February 4, 2026

Rivian has the cash it needs to build it, but are mass market consumers going to buy the R2?

Via The Motley Fool · February 2, 2026

On February 10, 2025, the narrative of the "Magnificent Seven" faced its most significant stress test to date. While the broader technology sector enjoyed a robust rally fueled by artificial intelligence optimism and strong corporate earnings, Tesla (NASDAQ:TSLA) emerged as the glaring outlier. The electric vehicle pioneer saw its

Via MarketMinute · February 2, 2026

Rivian and BYD are promising long-term plays on the EV market.

Via The Motley Fool · February 2, 2026

Both stocks are speculative, but one may stand out as the less risky choice.

Via The Motley Fool · February 2, 2026

Here are two hidden gems in the electric vehicle industry that could make investors wealthy over the long haul.

Via The Motley Fool · February 1, 2026

The little EV maker still has a lot to prove.

Via The Motley Fool · January 30, 2026

The global financial landscape has been jolted by a profound "Greenland rift" as the United States aggressively asserts its territorial ambitions over the autonomous Danish territory. This geopolitical friction, which reached a fever pitch in January 2026, has pitted Washington against Copenhagen and Brussels, triggering an unprecedented deployment of European

Via MarketMinute · January 30, 2026

Wall Street reached a monumental psychological and financial peak on Wednesday as the S&P 500 index briefly eclipsed and then closed near the 7,000-point mark for the first time in history. This breakthrough, occurring on January 28, 2026, represents a staggering 16.6% climb from the 6,000-point

Via MarketMinute · January 28, 2026

As of January 28, 2026, PACCAR Inc (NASDAQ: PCAR) stands at a pivotal crossroads between industrial tradition and a high-tech future. For over a century, the Bellevue-based manufacturer has been the "gold standard" of the heavy-duty truck market, known primarily for its premium Kenworth, Peterbilt, and DAF brands. However, the conversation surrounding PACCAR in early [...]

Via Finterra · January 28, 2026

Boston Dynamics' Atlas appears to have an edge over Tesla's Optimus.

Via The Motley Fool · January 28, 2026

The earnings report will give much-anticipated color on the company's pivot to software and services.

Via The Motley Fool · January 27, 2026