Go-to-market intelligence provider ZoomInfo (NASDAQ:GTM) reported Q3 CY2025 results beating Wall Street’s revenue expectations, with sales up 4.7% year on year to $318 million. Guidance for next quarter’s revenue was better than expected at $308.5 million at the midpoint, 1.2% above analysts’ estimates. Its non-GAAP profit of $0.28 per share was 9.5% above analysts’ consensus estimates.

Is now the time to buy ZoomInfo? Find out by accessing our full research report, it’s free for active Edge members.

ZoomInfo (GTM) Q3 CY2025 Highlights:

- Revenue: $318 million vs analyst estimates of $303.8 million (4.7% year-on-year growth, 4.7% beat)

- Adjusted EPS: $0.28 vs analyst estimates of $0.26 (9.5% beat)

- Adjusted Operating Income: $117.7 million vs analyst estimates of $111.7 million (37% margin, 5.4% beat)

- Revenue Guidance for Q4 CY2025 is $308.5 million at the midpoint, above analyst estimates of $304.8 million

- Management raised its full-year Adjusted EPS guidance to $1.05 at the midpoint, a 5% increase

- Operating Margin: 21.2%, up from 14.3% in the same quarter last year

- Free Cash Flow Margin: 30%, down from 32.6% in the previous quarter

- Customers: 1,887 customers paying more than $100,000 annually

- Billings: $277.5 million at quarter end, down 1.7% year on year

- Market Capitalization: $3.58 billion

Company Overview

Operating a platform it calls "RevOS" - short for Revenue Operating System - ZoomInfo (NASDAQ:GTM) provides sales, marketing, and recruiting teams with business intelligence and analytics to identify prospects and deliver targeted outreach.

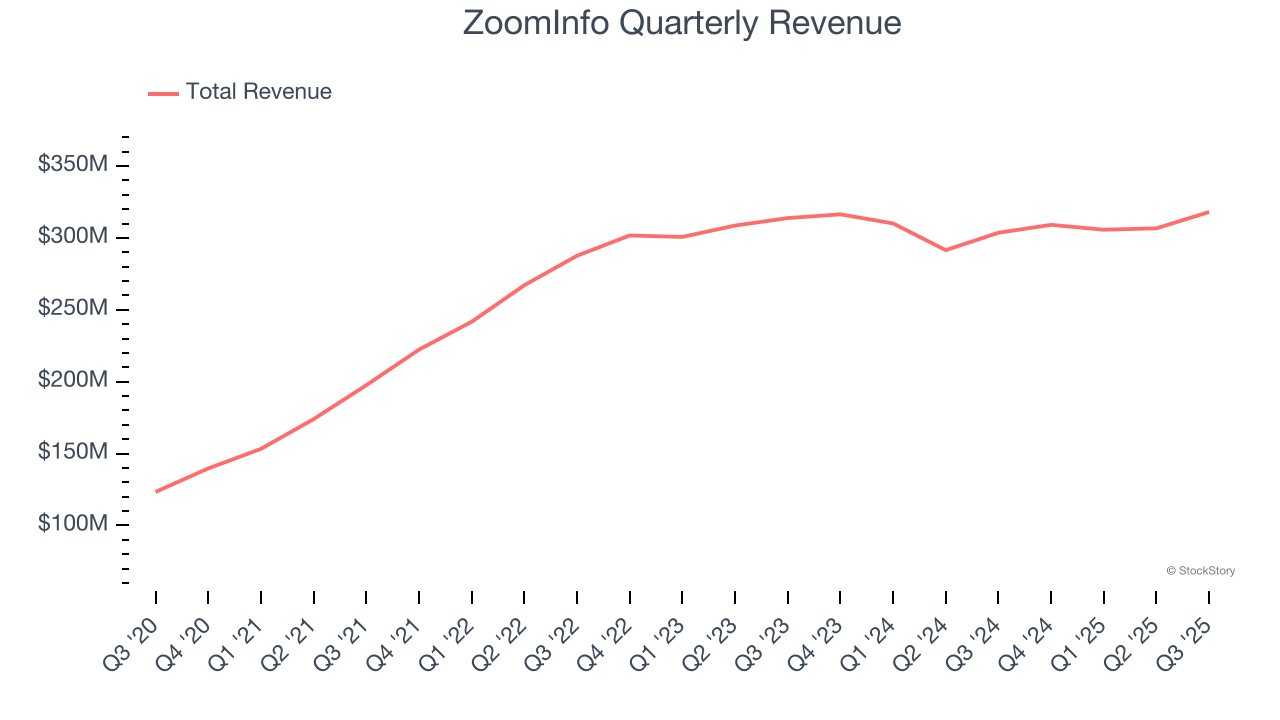

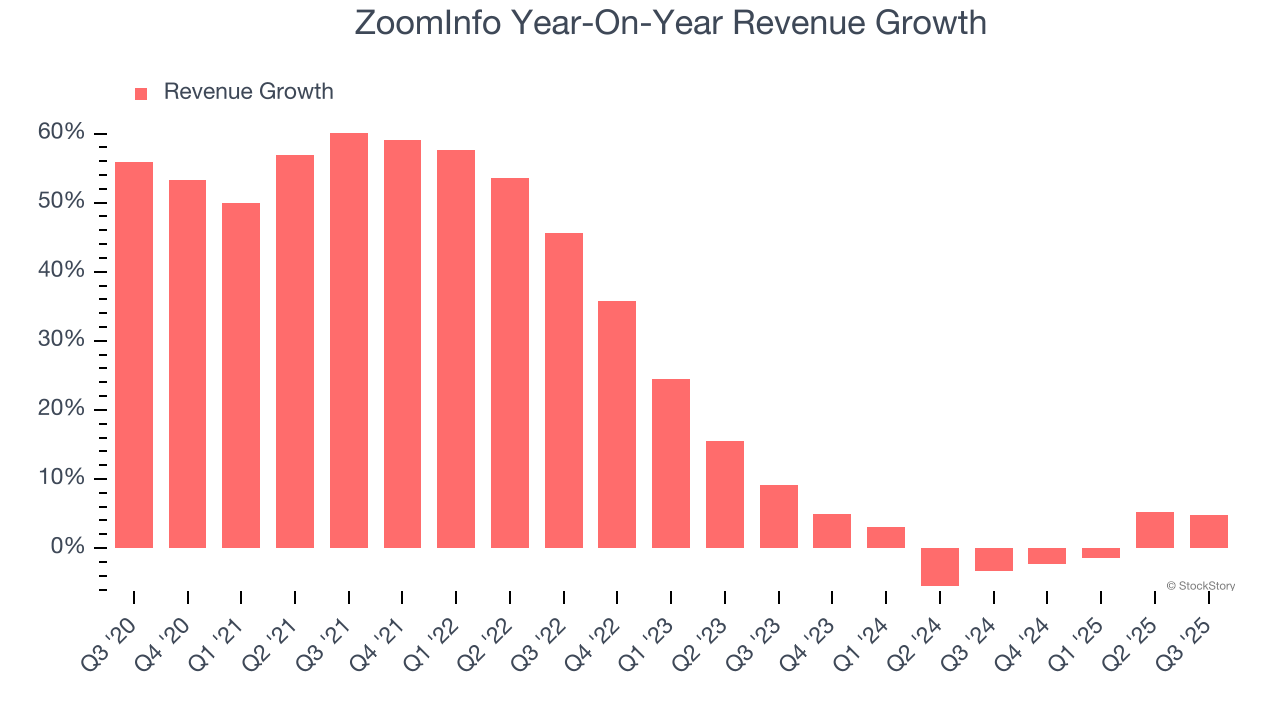

Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Thankfully, ZoomInfo’s 23.7% annualized revenue growth over the last five years was solid. Its growth beat the average software company and shows its offerings resonate with customers.

Long-term growth is the most important, but within software, a half-decade historical view may miss new innovations or demand cycles. ZoomInfo’s recent performance shows its demand has slowed as its revenue was flat over the last two years.

This quarter, ZoomInfo reported modest year-on-year revenue growth of 4.7% but beat Wall Street’s estimates by 4.7%. Company management is currently guiding for flat sales next quarter.

Looking further ahead, sell-side analysts expect revenue to decline by 1.3% over the next 12 months, a slight deceleration versus the last two years. This projection doesn't excite us and indicates its products and services will see some demand headwinds.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

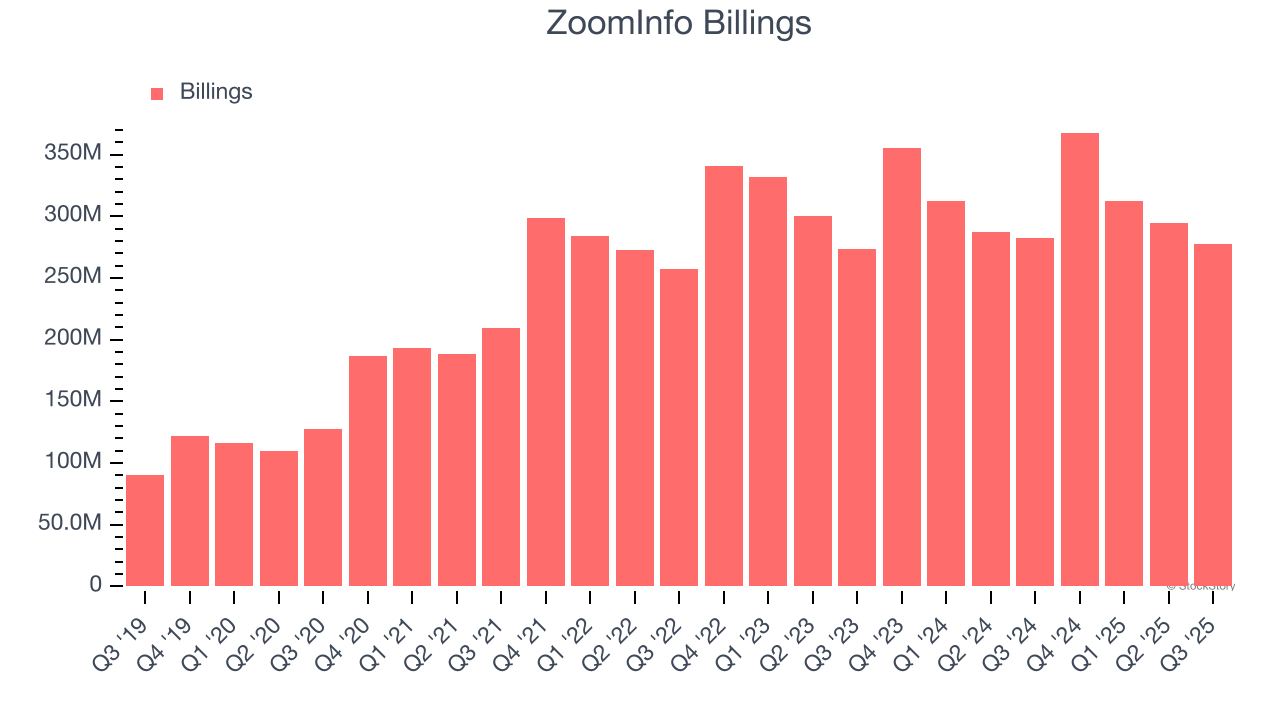

Billings

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

ZoomInfo’s billings came in at $277.5 million in Q3, and over the last four quarters, its growth was underwhelming as it averaged 1% year-on-year increases. This performance mirrored its total sales and suggests that increasing competition is causing challenges in acquiring/retaining customers.

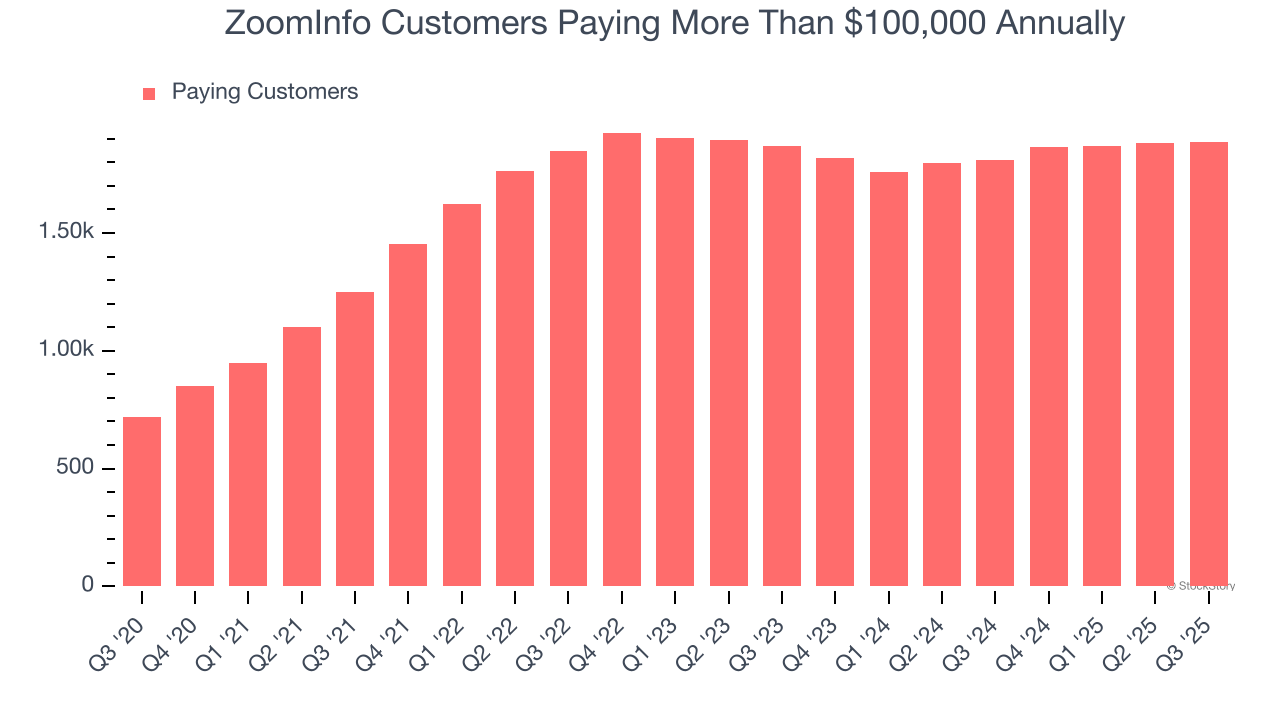

Enterprise Customer Base

This quarter, ZoomInfo reported 1,887 enterprise customers paying more than $100,000 annually, an increase of 3 from the previous quarter. That’s a bit fewer contract wins than last quarter and quite a bit below what we’ve observed over the previous year, suggesting its sales momentum with new enterprise customers is slowing. It also implies that ZoomInfo will likely need to upsell its existing large customers or move down market to accelerate its top-line growth.

Key Takeaways from ZoomInfo’s Q3 Results

We were impressed by ZoomInfo’s optimistic EPS guidance for next quarter, which blew past analysts’ expectations. We were also glad its full-year EPS guidance trumped Wall Street’s estimates. On the other hand, its new large contract wins slowed and its billings fell short of Wall Street’s estimates. Overall, this print was mixed but still had some key positives. The stock traded up 1.5% to $12 immediately after reporting.

Is ZoomInfo an attractive investment opportunity right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.