Vancouver, British Columbia--(Newsfile Corp. - July 29, 2025) - Cabral Gold Inc. (TSXV: CBR) (OTCQB: CBGZF) ("Cabral" or the "Company") is pleased to announce the results of an updated Prefeasibility Study ("Updated PFS") on the development of near-surface gold-in-oxide material at the Cuiú Cuiú gold district in Brazil. The Updated PFS, led by Ausenco do Brasil Engenharia Ltda. ("Ausenco"), resulted in significant improvements to the amount of gold produced, mine life, Net Present Value ("NPV") and Internal Rate of Return ("IRR") These results confirm the Cuiú Cuiú gold-in-oxide starter project provides a high return and a low capital entry point to mine gold, with production possible within 12 months from an investment decision.

Highlights

- Financial results from this larger project are a significant improvement on the October 2024 PFS ("PFS") with the Base Case after-tax NPV5, rising by almost 200% from US$25.2 million to US$73.9 million. The after-tax IRR has increased from 47% to 78% using a base case gold price of US$2,500/oz, with payback of the initial capital in under one year

- At the current Spot Gold1 price - US$3,340/oz, the after-tax IRR increases to 139% and the after-tax NPV5 to US$137 million

- Capital intensity has been reduced with initial capital cost essentially unchanged at US$37.7 million compared with US$37.4 million in the PFS study, including a 10% allowance on most quantities and 20% contingency

- The project has increased the annual processing capacity from 720,000 tonnes/yr to 1,000,000 tonnes/yr

- Mine life has increased from 4.4 to 6.2 years at the higher annual processing rate, with strong cash flows in the early years, resulting in the halving of investment payback from 18 months to 10 months2

- Probable Mineral Reserves have increased by 54% relative to the October 2024 PFS from a total 83,762oz to 128,908oz of gold from 6.2Mt @ 0.65 g/t gold

- Life of mine gold production has increased by 56% from 72,478 ounces to 113,155 ounces at an all-in sustaining cost ("AISC3") of US$1,210 / oz of gold produced

- Strong evidence exists of the potential for near-term growth in the gold-in-oxide resources at Cuiú Cuiú, particularly at the PDM and Jerimum Cima targets

The Oxide Starter Operation at Cuiú Cuiú is driven by the Company's long-term goal, which is to develop the region's second major gold mine in the Tapajos district. This Project carries out pre-stripping for the larger hard rock project, exposing the underlying primary gold mineralization, which reduces future waste mining costs. It also creates an initial operating platform that makes it easier to transition into primary ore production, and it generates significant cash flow to accelerate an aggressive and ongoing drilling and evaluation program aimed at finding the best pathway toward the subsequent larger development of the hard rock resources at Cuiú Cuiú.

The Company is in advanced negotiations regarding project financing with various parties, targeting a final investment decision (FID) in Q3 2025. Based on this plan, initial gold production is targeted for the second half of 2026.

Alan Carter, the President and CEO of Cabral Gold commented,

"We are delighted with the results from the Updated PFS on the Oxide Starter Operation at Cuiú Cuiú, which reflects the dedication of our team and consulting advisors. All key financial metrics have significantly improved since we issued the results of the PFS in October 2024.

While the required capital expenditures remain effectively unchanged at US$37.7 million, the after-tax NPV has surged by nearly 200% to US$73.9 million, and the after-tax IRR has risen from 47% to 78% over a longer project duration. The main driver behind these higher returns is the increased plant capacity, which reduces unit costs through economies of scale and allows for a lower cut-off grade, which results in higher Reserves. The addition of the Machichie mining area to the production schedule offers a new source of higher grade and near surface material, enabling the project to boost throughput and extend mine life simultaneously.

Recent drilling and trenching at Cuiú Cuiú has discovered a fifth gold-in-oxide blanket at Jerimum Cima, which currently lacks resources due to limited drilling. This target, along with the known gold-in-oxide resource at PDM, also not included in the Updated PFS, could offer opportunities for future expansion or extension of the mine life for the gold-in-oxide starter operation.

The Updated PFS has checked all our boxes and delivered a significantly larger starter project with very attractive early financial returns and quick payback, especially during a period of high gold prices.

In parallel with developing the Oxide Starter Operation at Cuiú Cuiú, the Company is currently undertaking an aggressive exploration drilling program aimed at pursuing the Company's main goal of increasing the primary hard rock resource base, and testing the highest potential targets within the Cuiú Cuiú gold district."

Overview

Cabral owns a 100% stake in the Cuiú Cuiú gold project, located in Pará State in northern Brazil, immediately adjacent to GMining's major Tocantinzinho gold mine. Cuiú Cuiú was the largest producer of placer gold during the 1980s Tapajós gold rush. The project area covers an entire gold district.

In 2021, the Company recognized the economic potential of several gold-in-oxide blankets created by the weathering of the higher-grade primary gold deposits at Cuiú Cuiú. An internal desktop study verified that these oxide resources could support the development of an initial simple, low-cost starter production facility that could be set up in the short term based on the existing Trial Mining Licenses. Additionally, this study indicated that such an operation could generate substantial cash flows, enabling the Company to self-fund an aggressive and ongoing drilling program aimed at significantly expanding the global resource estimate.

During October 2024, the Company completed a PFS-level study on a simple and low-cost starter operation with the scope to assess short-term pathways to production that were aligned with Cabral's financial capacity (see press release dated October 21, 2024). The PFS study resulted in robust financial returns, including a 47% post-tax IRR and an 18-month payback at an assumed gold price of $2,250 per ounce. However, it was recognized that with more time, significant improvements in the project were likely, particularly the inclusion of resources from the nearby Machichie deposit, and an increase in processing capacity to better accommodate the district's oxide resource potential. Therefore, the Company decided to undertake additional resource drilling and metallurgical studies to better understand the Machichie deposit, as well as engineering studies to optimize the project design outlined in the PFS.

Mineral resources have been updated for Central and Machichie based on drilling completed in late 2024 and 2025. At MG and PDM, resources remain the same as in 2024 since there was no new drilling or resource modeling. The project now contains a total of 13.6 Mt averaging 0.50 g/t Au in Indicated Resources and 6.4 Mt averaging 0.34 g/t Au in Inferred Resources.

Economic Analysis

The gold-in-oxide project demonstrates very strong financial metrics across a variety of gold price scenarios as shown in Table 1, highlighting the potentially attractive returns and quick payback period. A comparison with the financial results of the initial PFS released in October 2024 is also included.

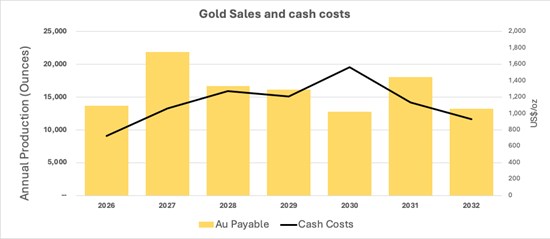

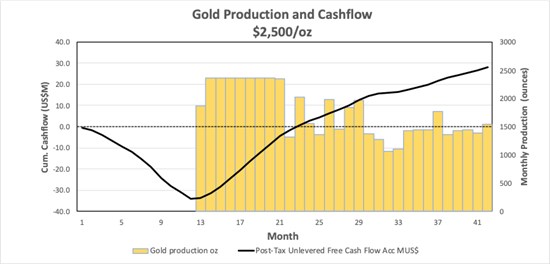

The after-tax NPV5 has increased by almost 200% from US$25.2 million to US$73.9 million in the Updated PFS. The after-tax IRR has also increased significantly from 47% to 78%. In addition, the higher annual processing rate results in strong cashflows in the early years almost halving of investment payback from 18 months to 10 months in the Updated PFS4 (Figures 1 and 2).

| US$M | PFS October 2024 | Low | Base Case | Mid | Spot | High |

| Gold Price (US$/oz) | 2,250 | 2,250 | 2,500 | 3,000 | 3,340 | 3,500 |

| After Tax NPV5 | 25.2 | 54.8 | 73.9 | 112.0 | 137.8 | 149.9 |

| After Tax IRR | 47% | 59% | 78% | 114% | 139% | 151% |

| Payback (years) | 1.5 | 1.1 | 0.8 | 0.7 | 0.6 | 0.5 |

| Average annual EBITDA (First 24 months) | 23.8 | 26.9 | 32.1 | 42.5 | 49.5 | 52.9 |

| LOM EBITDA | 79.5 | 127.4 | 154.4 | 208.4 | 245.2 | 262.5 |

| LOM After Tax Cashflow | 32.8 | 71.5 | 94.4 | 140.2 | 171.3 | 186.0 |

Table1. Key results of Updated PFS financial analysis and sensitivities to commodity prices

Figure 1 Graph showing gold produced and production costs by year

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3900/260474_530db38cc49e48ad_002full.jpg

Figure 2 Monthly gold production and project payback for initial 3.5 years from Investment Decision

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3900/260474_530db38cc49e48ad_003full.jpg

Updated PFS - Detailed Results

The following tables (Tables 2 and 3) provide both key assumptions used to complete the financial analysis and the primary operational statistics for the project.

Oxide Probable Reserves have increased by 54% from a total 83,762oz in the October 2024 PFS to 128,903oz of gold. Processing and heap leach capacity has similarly increased by 39% from 720,000 tonnes per annum to 1,000,000 tonnes per annum, and the waste to ore ratio has dropped from 0.93 in the October 2024 PFS to 0.78 in the Updated PFS. Life of Mine gold production has risen by 52% from 72,478 ounces to 113,155. All of this, whilst capex costs have essentially remained unchanged at US$37.7 million compared with US$37.4 million in the October 2024 PFS. Life of Mine AISC costs also essentially remain unchanged and were US$1,228 / oz in the October 2024 PFS compared with US$1,210 / oz in the Updated PFS.

| Operational Assumptions | Unit | |

| Contained Gold in Mine Plan | oz | 128,926 |

| Mill and Heap Leach Capacity | t/annum | 1,000,000 |

| Monthly Plant Feed | tonnes | 83,333 |

| LOM Mined Grade | g/t | 0.65 |

| Strip Ratio | Waste:Ore | 0.78 |

| LOM Ore Mined | tonnes | 6,179,379 |

| LOM Material Movement | tonnes | 10,993,399 |

| Average Gold recovery | % | 87.8% |

| Production | ||

| Mine life | Years | 6.2 |

| Gold Production (First 24 months) | oz | 43,342 |

| LOM Gold Production | oz | 113,155 |

| Average Annual Production (6.2 year mine life) | koz | 18.5 |

| Project Costs | ||

| Pre-production Capital Expenditure | US$M | 37.7 |

| Sustaining Capital Expenditure | US$M | 8.02 |

| LOM Average Site Operating Costs | US$/tonne ore | 18.2 |

| LOM Average Site Operating Costs | US$/oz | 1,000 |

| LOM Average AISC | US$/oz | 1,210 |

Table 2. Economic analysis summary

| Commercial Parameters | Unit | |

| Exchange Rate | USD:BRL | 5.7 |

| Corporate Tax Rate | % | 25.0% |

| Social Tax | % | 9.0% |

| SUDAM Tax Reduction | % | 75.0% |

| Gold Royalty Osisko Gold Royalties | % | 1.0% |

| Gold Royalty Versamet | % | 1.5% |

| Selling and Refining Costs | US$/oz | 30.0 |

Table 3. Key assumptions

Resources

Overlying the primary gold mineralization at Cuiú Cuiú is an oxide zone of weathered and oxidized intrusive saprolite material ("saprolite"). Above the saprolite, gold is present in an erosional blanket of colluvium and other poorly consolidated sediments ("blanket"). The Updated PFS focuses on the Indicated Resources within the saprolite and overlying blanket, where the relatively soft or poorly consolidated material is easily excavated, and gold is highly amenable to heap leaching.

Cabral updated resource models within the oxide zone at the Central and Machichie targets based on additional drilling of 4,755 metres at Central completed in late 2024, and 2,823 metres at Machichie completed in 2025. Central and Machichie resources were calculated constrained within a pit shell using a gold price of $2,600 per ounce at a 0.1 g/t cut-off grade and are shown in Table 4. Resources in the Indicated category have increased by 26% to 13.6Mt @ 0.50 g/t gold compared with the October 2024 PFS study. Resources at MG and PDM were not updated or recalculated as there was no new drilling or model changes, and are stated as in the 2024 43-101 Technical Report and Prefeasibility Study (see note 4 of Table 4).

The resource estimates do not include resources in the underlying primary (hard rock) material, which account for approximately 80% of the total resources at the Cuiú Cuiú project.

Inferred Resources are not considered as part of the Updated PFS study. Indicated and Inferred Resources across four known deposits are shown in Table 4.

| Cut-off Grade | Inferred Resources | Indicated Resources | ||||

| 0.1 g/t | Tonnes | Grade | Ounces | Tonnes | Grade | Ounces |

| MG | 3,142,921 | 0.223 | 22,508 | 8,857,901 | 0.477 | 135,855 |

| Central | 941,636 | 0.448 | 13,558 | 3,364,519 | 0.520 | 56,204 |

| Machichie | 714,188 | 0.540 | 12,403 | 1,334,744 | 0.562 | 24,123 |

| PDM | 1,600,000 | 0.430 | 22,100 | |||

| Total | 6,398,745 | 0.343 | 70,569 | 13,557,164 | 0.500 | 216,182 |

Table 4. Indicated and Inferred resources of oxide material only

Notes:

- All estimates of Mineral Resources have been prepared in accordance with National Instrument 43 - 101 - Standards of Disclosure for Mineral Projects ("NI 43-101").

- The effective date is July 23, 2025.

- The independent and qualified persons ("QPs") for the mineral resource estimates as defined by NI 43-101, Henrique da Silva, US Consultants LLC (for Central resources) and Walter Dzick (P.Geo) Principal Geological Consultant of Dzick Geosconsultants (for Machichie)

- MG and PDM resources are quoted from 2024 NI 43-101 Technical Report & Prefeasibility Study, effective date of October 9, 2024

- Central and Machichie resources were estimated within pit shells using $2600 gold price and a 0.1 g/t Au cut-off grade.

- These mineral resources are not mineral reserves.

- Numbers may not add due to rounding

Mining

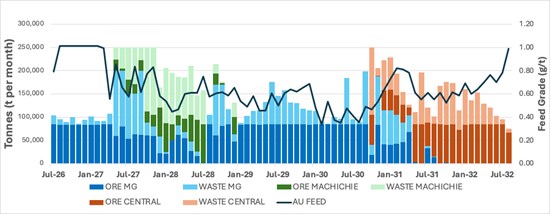

The Updated PFS contemplates open-pit mining using conventional methods. Initially, ore will be sourced from three mining areas. The Moreira Gomes (MG) pit accounts for approximately 65% of the run of mine (ROM) ore with the balance coming from the Machichie main deposit (10%) located 500m from the ROM pad and the Central Pit (25%), located approximately 5km from the location of the ROM pad.

Figure 3 shows the Project layout, including the mining areas (MG and Machichie) relative to the processing plant.

Figure 3. Project layout, including the mining areas (MG and Machichie) relative to the processing plant.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3900/260474_530db38cc49e48ad_004full.jpg

Figure 4 shows the various material movement rates by month, highlighting the low level of waste stripping during the payback period5.

Figure 4. Material movement schedule by month

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3900/260474_530db38cc49e48ad_005full.jpg

Pit designs were completed at a gold price of $2,250/oz, with a key focus on prioritizing the highest-grade ore in the mine plan. This maximized IRR and margin, shortened payback, and provided strong short-term cash flow to derisk the investment decision and improve the attractiveness to potential investors and financiers.

The pit designs incorporated 5-meter bench heights and ramps 10 meters wide. Geotechnical stability analysis, based on benchmarking data and field evaluation, supported inter-ramp angles of 45 degrees, with a total pit angle ranging from 30 to 45 degrees (including ramps).

Mining will be conducted using an excavator in the overhand position, loading a fleet of 35-tonne trucks supported by a front-end loader. The oxidized resources are found within loose, weathered blanket material, which can be mined with an excavator, dozer, and ripper without the need for drilling and blasting.

Mining activities will probably be outsourced to one of the many full-service contract miners operating in Para State. Contract mining agreements will include providing the entire mining fleet, along with operating labor and necessary maintenance services. Cabral will supply the fuel needed to run the fleet from a mine site storage and dispensing facility.

Ore from the open pits will be delivered to a ROM pad within 200 meters from the exit of the MG pit.

Mineral Reserves

Probable Reserves for the project have been updated since the PFS and have increased by 54% from a total 83,762oz to 128,903oz of gold. The totals are outlined in Table 5 below;

| Tonnage (Kt) | Grade (g/t Au) | Ounces Au | |

| MG | 4,035 | 0.64 | 82,912 |

| Central | 1,511 | 0.62 | 29,959 |

| Machichie | 632 | 0.79 | 16,032 |

| Total | 6,178 | 0.65 | 128,903 |

Table 5 Probable Mineral Reserves (gold-in-oxide material only)

Notes:

- CIM (2014) definitions were followed for Mineral Reserves.

- Mineral Reserves have an effective date of July 23, 2025. The Qualified Person for the estimate is Bruno Yoshida Tomaselli, B.Sc., FAusIMM, an employee of Deswik.

- Mineral Reserves stated herein are Probable Reserves confined within an optimized pit shell that uses the following parameters: gold price including refining costs US$ 2,250/oz; mining costs US$ 4.20/t; processing costs US$ 10.00/t processed; G&A costs US$ 1.5 M/a; process recovery of 75% at Central and 85% at Machichie and MG; mining dilution of 5% at MG and Central and 10% at Machichie; ore recovery of 95%; pit overall slope angles that range from 30 - 45°.

- Tonnages and grades have been rounded in accordance with reporting guidelines. Totals may not sum due to rounding.

Metallurgical results

Metallurgical test work was completed at Kappes Cassiday and Associates (KCA) in Reno, NV, on a total of ten oxide material samples from the MG, Central, and Machichie deposits. KCA performed a series of tests on each composite, including coarse and fine milled bottle roll leach tests, compacted permeability tests, and column leach tests. Gold extractions in the bottle-roll leach tests generally exceeded 90%, with a maximum recovery of 98% achieved after 336 hours of leaching.

Column leach tests were performed using material crushed to 100% passing 50 millimeters for MG and Central, and 25 mm for Machichie. The material was agglomerated with 15 to 20 kg/t of cement. To replicate the height of the proposed leach pads, the MG and Central material was loaded into 5-meter-tall, 8-inch (203 mm) diameter columns, which were leached for 68 to 112 days with a cyanide solution. The Machichie material was loaded into 2.4-meter-tall, 6-inch (150 mm) diameter columns, which were leached with cyanide for 22 to 35 days.

In general, gold recoveries within columns were excellent, with most of the final leach extractions achieved within the first few weeks of the cycle. Recent testwork, which focused on the Machichie ore, returned recoveries of 91% in the saprolite and 96% in the blanket sediments. A blended estimate recovery of 88% was used for Machichie ore in the Updated PFS. The recoveries for Central (87%) and MG (88%) were consistent with the assumptions used in the October 2024 PFS.

Saprolite at MG and Machichie is highly oxidized, resulting in high porosity and very good gold recoveries, especially when agglomerated. Central saprolite is comparatively coarser grained with less natural leaching, leading to slightly lower recoveries. Blanket material at all deposits shows variability in gold recoveries but consistently yields very high recoveries due to the high level of oxidation in the near-surface environment.

Based on these test results and our understanding of the ore types, Ausenco has determined the following heap leach recoveries for the different ore types based on a 60-day leach cycle, using on/off operation.

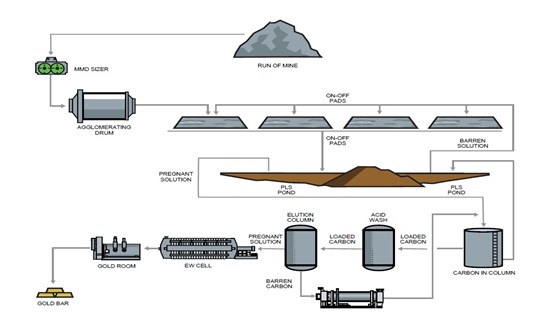

Processing

The Cuiú Cuiú processing facility has been designed with a capacity of 3,000 tpd. This is a 50% increase from the 2,000 tpd contemplated in the PFS of October 2024.

The process plant will include a mineral sizer (MMD Sizer) fed from a ROM pad, producing an ore stream with an 80% passing size of 50 mm (2"). The crusher discharge will be agglomerated using cement and barren leach solution, then transported by portable conveyors to the on/off heap leach pads. There will be four leach pads, each with a designed capacity of 83,333 tonnes at a stacked ore height of 5 meters. One or two pads will be leaching at any given time, with an irrigation rate of 12 L/h/m2. Pads not currently leaching will be in the process of being prepared or cleaned of spent ore. Although the leach cycles are assumed to last 60 days, some of the softer blanket material may be leached in a shorter time without significantly affecting process recovery.

Pregnant leach solution (PLS) will be pumped to the carbon-in-column (CIC) circuit at an average flow rate of 215 m³/h, targeting a loaded carbon Au grade of 2,500 g/t. This will be processed in a 2.0-tonne capacity Adsorption/Desorption and Recovery (ADR) plant. The ADR plant will include an acid wash column, elution column, carbon regeneration kiln, electrowinning cell, sludge filter press, sludge drying oven, and smelting furnace.

Once the leach cycle is complete, the pads will be completely rinsed during a 14-day period, and if required, the solution will be detoxified using lime and hydrogen peroxide prior to initiating the rinsing process. The gold recovery flowsheet for the project is shown in Figure 5.

Figure 5 Process flow sheet

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3900/260474_cabralfig5.jpg

Access and Infrastructure

The Cuiú Cuiú project is located approximately 195 km southwest of Itaituba, a town on the Tapajós River. The Cuiú Cuiú village lies 60 km north of the regional road BR-163, which is the main supply route for the Tocantinzinho Gold Mine, Brazil's third-largest open pit gold mine. The Cuiú Cuiú access road will need an upgrade to an all-weather gravel road to support year-round servicing of the mine with 20-25 tonne loads.

These road upgrades on the municipal road are currently underway in partnership with the local Itaituba government, including widening the road to 10 meters to allow drying during daylight hours, correcting the final route to avoid historically problematic areas, redoing two major bridges, and building 9 new department of transit (DNIT) standard bridges totaling 126 meters (see Figure 6).

Figure 6 Main Tocantinzinho River Bridge fully upgraded. Capacity of up to 90t loads.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3900/260474_530db38cc49e48ad_007full.jpg

The next stage of road upgrades will involve cutting and filling of high and low points in the terrain and installing permanent drainage systems, with the final step being the laying of high-quality paving using gravel and sand.

Cabral's main camp is situated in the village of Cuiú Cuiú, next to the project site. The village has 80 houses and, in 2022, supported approximately 200 families. The Updated PFS assumes the addition of more lodging and support facilities to house an extra 60 workers during both the construction and production phases.

The Cuiú Cuiú township is served by a 1,000-meter-long unpaved airstrip maintained by the Company. It provides air access to Itaituba, the project's regional supply and service town.

Power for the project will be supplied by a diesel generator bank. One benefit of a heap leach operation is its relatively low energy consumption and the absence of a need to build grid connection infrastructure at this early stage.

Discussions are ongoing with federal authorities to install a small UTE (Thermal Electric Power Plant) at Cuiú Cuiú as part of the federally funded Light For All Program, with similar plants installed at the nearby Sao Chico and Creporizao communities on the Trans-Garimpeiro highway. This initiative has the potential to supply grid power to the processing plant in the future and significantly lower anticipated energy costs.

Mining Permits

The Project is predicated on the current Trial Mining Licenses, which include a limit in ore processing of 500,000t/year for the project area. The Trial Mining License ("GU") for 850.047/2005 (MG deposit) was renewed for 3 years on 30/05/2025 with increase on volume to 300,000t / year. The Trial Mining License (GU) for 850.615/2004 (Central deposit) is in the renewal process for a further 3 years and is currently approved for 200,000t / year.

The LI (Installation License for the 2 GUs) was renewed for 2 years on 13th of June 2025.

New ASV (Vegetation Supression) and Rescue of Fauna licenses were received and published on the 25th of July 2025 and are valid for 1 year.

Applications for the environmental license on the Full Mining License (Protocolo da Lavra) were made in December 2020, and following feedback from SEMAS/PA, an updated EIA-RIMA was submitted reflecting the evolution of the project since 2020 and the application was finalized in Q1 2025. Analysis of the EIA-RIMA (Background Environmental Study for the Full Mining License) is now complete and public audiences are planned for the near future. We expect to receive positive endorsement during these public audiences following which COEMA (State Environmental Council) will fully assess our application and communicate its findings early in September. With the support of COEMA, the LP (Preliminary License) for the Full Mining License is expected in September 2025. This is an important step in the Full Mining License approval process, which will be followed by submission of detailed engineering and a request for the Installation License (LI) for the full 1Mt/yr mining operation.

Capital Costs

The capital cost estimate was compiled based on the proposed plant design by Ausenco. Approximately 70% of the direct costs within the Updated PFS capital cost estimate are based on supplier quotations.

A priority for the current engineering phase is finalizing these costs through detailed engagement and negotiation with preferred suppliers, and completing engineering design for the project.

The total Initial capital cost estimate is US$37.7 million including a 10% allowance on most materials and a 20% Contingency on all direct and indirect Costs. This capital cost estimate compares with the US$37.4 million estimate from October 2024. A detailed breakdown of the initial capital costs is shown in Table 6.

| Area | Detail | US$ million |

| Process Plant | ||

| Heap Leach Pads | 5.89 | |

| Process Equipment | 7.92 | |

| Infrastructure | ||

| Onsite | 5.66 | |

| Offsite | 1.58 | |

| Earthworks | 3.81 | |

| Indirect Costs | 5.81 | |

| Owners Costs | 0.74 | |

| Project Contingency | 6.28 | |

| Total Initial Capital Expenditure | 37.70 | |

Table 6. Capital costs breakdown

Sustaining Capital

Sustaining Capex for the project is limited to expanding waste dumps and the spent ore pile, which are necessary as waste and ore processed increase over the mine's lifespan. This future investment is needed because unnecessary spending on containment structures has been intentionally delayed until required, shifting investment from Initial Capex to Sustaining Capex.

The forecast for the estimate of Sustaining Capex, includes direct costs plus engineering, procurement and contingency. Table 7 is a summary of this future investment.

| US$ 000's | 2027 | 2028 | 2029 | 2030 |

| MG Waste Facility Expansion | 0 | 1,884 | 0 | 0 |

| Central Waste Facility | 0 | 0 | 0 | 2,552 |

| Spent Ore Pile Expansion | 0 | 3,579 | 0 | 0 |

| Total | 0 | 5,463 | 0 | 2,552 |

Table 7. Sustaining capital costs breakdown

Operating Costs

Operating costs were calculated using key operating design parameters, unit cost assumptions, and estimates for manning and indirect costs. Pricing for reagents and consumables was obtained from qualified local suppliers and reflects expected project prices.

Mining costs were based on proposals received from appropriately qualified civil engineering companies offering contract mining services. These proposals included a comprehensive service package, including equipment rental, operating staff, and mobilization and demobilization. Cabral will supply fuel to the mining fleet. The unit cost of the complete service is estimated at $3.98 per tonne of material moved. Going forward, Cabral will conduct a competitive bidding process and detailed negotiations with preferred contract miners to establish a firm price for this service, which represents about one-third of the mine operating expenses.

A detailed breakdown of the Mine's operating costs is shown in Table 8.

| Item | LOM Ave. US$/t | LOM US$ M | LOM Ave. US$/oz |

| Mining | 7.08 | 44 | 388 |

| Processing | 10.54 | 65 | 579 |

| Site G & A and Support Services | 0.60 | 4 | 33 |

| Site Production Costs | 18.22 | 113 | 1,000 |

| Selling Costs | 3 | 30 | |

| Royalties | 11 | 99 | |

| Production costs plus Royalties | 127 | 1,129 | |

| Closure Costs | 1 | 10 | |

| Sustaining/Deferred Capital Expenditure | 8 | 71 | |

| AISC | 136 | 1,210 |

Table 8. Operating costs breakdown on a per ounce basis

Upside Opportunities

A key additional output of the Updated PFS is the identification of several more improvement and optimization opportunities that will be addressed during the engineering and implementation phase. These opportunities could further boost the already attractive investment returns, extend the Life of Mine (LOM) and increase the NPV. These opportunities are listed in Table 9.

| Opportunity | Potential Benefits |

| Resource/Reserve Growth | The Company believes there is a high probability of adding Indicated Resources at both the Jerimum Cima and PDM targets. An increasing Gold Price environment will support including more mineralization in the mine plan by lowering the processing cut-off grade further. Increased Reserves will positively impact Mine life and NPV which are very sensitive to increased Reserves. |

| Exploration Growth - Identify new resources | The Cuiú Cuiú district has many peripheral targets with positive trench and drill results in oxide material which are at an earlier stage of definition than Jerimum Cima and PDM. These targets need to be drill tested to further assess their potential for inclusion into the Oxide Project LOM plan. |

| More competitive OPEX | The cost of contract mining and cement used in ore agglomeration were sourced from indicative quotations from reputable suppliers. These costs account for approximately 50% of the production Opex. It is likely that these costs may be reduced through a competitive bidding process and detailed negotiation which is being planned in the next phase of work. |

| Reduction in Capex | Opportunities exist to reduce Capex from the Updated PFS estimate of $37.7 million. These include accessing more competitive pricing for major items and local sourcing of some secondary experiment and services. |

| Project Expansion - Oxides | Success in increasing oxide Reserves provides the opportunity to explore further increases in capacity for the Heap Leach Pads. Space has been reserved and prepared in the plant layout to accommodate a fifth HL pad, which would increase processing capacity or leach time for each batch, both of which should increase total gold production during the proposed 6.2-year mine life. |

| Project Expansion Pathways | The starter project is expected to remove much of the oxide material, in some cases exposing higher grade primary ore. The existing operating base and the easy access to higher-grade ore at the bottom of the oxide pit provides a low-cost opportunity to commence larger-scale exploitation of the primary ore |

Table 9. Opportunities for further improvements

Project Sensitivities

Tables 10 and 11 show the sensitivities of the project IRR and NPV5 to key parameters including gold price, initial capital and total operating costs.

| Gold Price US$/oz | After-Tax | Initial Capital | Total Operating Costs | ||

IRR | |||||

| Base Case | -20% | 20% | -20% | 20% | |

| 2,250 | 59% | 83% | 44% | 73% | 45% |

| 2,500 | 78% | 106% | 60% | 91% | 64% |

| 3,000 | 114% | 153% | 90% | 127% | 102% |

| 3,340 | 139% | 186% | 110% | 152% | 127% |

| 3,500 | 151% | 201% | 119% | 163% | 139% |

Table 10. After Tax Project IRR sensitivities according to key parameters

| Gold Price US$/oz | After-Tax | Initial Capital | Total Operating Costs | ||

| NPV5 | |||||

| Base Case | -20% | 20% | -20% | 20% | |

| (US$M) | |||||

| 2,250 | 54.8 | 61.3 | 48.1 | 70.6 | 38.2 |

| 2,500 | 73.9 | 80.4 | 67.4 | 89.7 | 58.1 |

| 3,000 | 112.0 | 118.4 | 105.5 | 127.6 | 96.2 |

| 3,340 | 137.8 | 144.2 | 131.3 | 153.4 | 122.1 |

| 3,500 | 149.9 | 156.3 | 143.5 | 165.6 | 134.2 |

Table 11. After Tax Project NPV sensitivities according to key parameters

Next Steps

The Company is well advanced in discussions regarding project financing with various parties with the objective of achieving an investment decision by the Cabral Board of directors during th second half of 2025, which would result in initial gold production during the second half of 2026.

Qualified Persons Statement

The Updated PFS Study was authored by independent Qualified Persons and is in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects. The following Qualified Persons ("QPs") are responsible for the Updated PFS Study and have reviewed the information in this news release that is summarized from the Updated PFS Study in their areas of expertise:

- Robert Raponi (P. Eng), Principal Metallurgist with Ausenco Engineering) is responsible for project infrastructure, recovery methods, capital and operating costs relating to processing, and economic analysis.

- Scott Elfen (P. E.), Global Lead Geotechnical and Civil Services with Ausenco Engineering) is responsible for heap leach and tailings infrastructure, capital and operating costs relating heap leach and tailings infrastructure.

- Henrique da Silva, Principal Geostatistician of US Consultants LLC is responsible for the sample preparation, data verification and mineral Resource estimation for Central

- Rodrigo de Brito Mello (P.Geo), Director and owner of RBM Serviços Técnicos Ltda, is responsible for the geological setting, deposit type, exploration, drilling, and adjacent properties.

- Bruno Tomaselli (Consulting Manager), of Deswick Brasil, is responsible for mining method and operating costs related to the mine.

- Walter Dzick (P.Geo) Principal Geological Consultant of Dzick Geosconsultants , is responsible for the sample preparation, data verification and mineral Resource estimation for Machichie

Brian Arkell, VP Exploration and Technical Services of Cabral Gold Inc., a QP as defined in NI 43-101, has reviewed this press release on behalf of the Company and has approved the technical disclosure contained in this news release. The Updated PFS Study will be summarized in a technical report that will be filed on the Company's website at www.cabralgold.com and on SEDAR at www.sedarplus.ca in accordance with NI 43-101 within 45 days of this news release.

About Cabral Gold Inc.

The Company is a junior resource Company engaged in the identification, exploration, and development of mineral properties, with a primary focus on gold properties located in Brazil. The Company has a 100% interest in the Cuiú Cuiú gold district located in the Tapajós Region, within the state of Pará in northern Brazil. Three main gold deposits have so far been defined at the Cuiú Cuiú project which contain National Instrument ("NI") 43-101 compliant Indicated resources of 12.29Mt @ 1.14 g/t gold (450,200oz) in fresh basement material and 13.56Mt @ 0.50 g/t gold (216,182oz) in oxide material. The project also contains Inferred resources of 13.63Mt @ 1.04 g/t gold (455,100oz) in fresh basement material and 6.4Mt @ 0.34 g/t gold (70,569oz) in oxide material. The resource estimate for the primary material is based on the NI 43-101 technical report dated October 12, 2022. The resource estimate for the oxide material at PDM and MG is based on a NI 43-101 technical report dated October 21, 2024. The resource estimate for the oxide material at Central and Machichie is based on the results of the Updated PFS reported on 29th July 2025 with a NI 43-101 technical report expected to be filed within 45 days of this news release.

The Tapajós Gold Province is the site of the largest gold rush in Brazil's history which according to the ANM (Agência Nacional de Mineração or National Mining Agency of Brazil) produced an estimated 30 to 50 million ounces of placer gold between 1978 and 1995. Cuiú Cuiú was the largest area of placer workings in the Tapajós and produced an estimated 2Moz of placer gold historically.

FOR FURTHER INFORMATION PLEASE CONTACT:

"Alan Carter"

President and Chief Executive Officer

Cabral Gold Inc.

Tel: 604.676.5660

Neither the TSX Venture Exchange nor its Regulation Services Provider (as such term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-looking Statements

This news release contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively "forward-looking statements"). The use of the words "will", "expected" and similar expressions are intended to identify forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements. Such forward-looking statements should not be unduly relied upon. The Company believes the expectations reflected in those forward-looking statements are reasonable, but no assurance can be given that these expectations will prove to be correct.

1 Spot Price based on 28th July, 2025 traded price

2 Period from Production startup, 22 months from investment decision

3 Includes all cash operating costs, product treatment and transport charges, private and government royalties, sustaining capex, deferred capex and closure costs.

4 Period from Production startup, 22 months from investment decision

5 The period required to pay back the initial capital, excluding interest

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/260474