Toncoin Price and Market Situation

Toncoin (TON) is currently trading at around $1.48 USD , which is considered to be consolidation following the volatile trading in 2025. Such price level places TON at a good distance to some of the past peaks, which means that the market is at the stage of correction, accumulation, and not the high pace upwards movement. The trading range and the sentiment of TON are vulnerable to the general dynamics of the crypto market and the trends of ecosystem engagement.

Price Projection and Trend of 2026

In throwing forward the price of TON to 2026, various models of various authoritative figures provide various alternatives of the possible outcome of the project on the basis of historic performance data, technical indicators, and long-term demand projections:

- Moderate Growth Case: A pretty popular technical projection is that Toncoin will be in a range of at least about $1.68 USD and at most about $3.18 USD in 2026, averaging around $2.36 USD in price in case the market does stabilize and uptake is slow.

- The forecasts suggest: that in the case of moderate bullish developments, TON will have a wider potential trend, and it is expected to have a range of between$ $1.46 USD to 2.14 USD in the year 2026.

All these forecast brackets represent different macroeconomic cycle assumptions, investor sentiment, utility growth, and network adoption assumptions. The lower end reflects the situation, in which the general crypto equities are gradually recovering, and the higher targets presuppose the more active market operation, as well as the greater demand at TON with the development of the ecosystem.

Basic Motivations of Toncoin Price Movement.

The main market and network variables that affect the future performance of Toncoin include:

1. Ecosystem Adoption:

Diversified on-chain solutions, such as decentralized applications and stablecoin issuance via the network of Toncoin, also add to the underlying demand as a result of more than trade speculation.

2. Network Utility and Integration:

Combining with messaging platforms and cross-chain infrastructure will allow TON to have more applications, which might facilitate liquidity and transactional demand in the long term.

3. Supply Dynamics:

Short term price pressure can be affected by scheduled token unlocks and increases in supply in circulation. Big unlocks are conventionally followed to see what impact they may have on the sell-side, but can as well support ecosystem distribution should they be consumed by the demand.

4. Macro and Crypto Market Cycles:

The performance of Toncoin tends to be associated with the sentiment in the wider digital asset market; macroeconomic factors and the willingness to risk among investors are the main factors that drive the flow of capital to mid-cap tokens such as TON.

Supply Trends in 2026

Trends in supply of TON are the circulating token supply and ecosystem allocations. Circulating supply can change in 2025 and 2026 with a series of unlocks of Toncoin, which are ecosystem or incentive allocations. Such events are normally monitored by market participants because higher liquidity may put downward pressure on prices in case the demand does not increase in the same measure. Nevertheless, as network adoption grows with supply, the extra tokens can be consumed by utility applications instead of buying volatility.

Staking Stablecoin Contract: Intended Use and Design by Poain.

The volatility of prices is also not a new issue in terms of cryptocurrency investment, especially in the case of assets such as TON where the price movement varies in accordance with the sentiment and adoption patterns. Poain, in his Staking Stablecoin Contract, attempts to solve this issue by providing a different participation structure which aims at earning yield by allocating stablecoins instead of basing it only on price increases.

The Stablecoin Staking Contract.

- Stablecoin Deposits: Stablecoin users commit their coins to fixed term staking agreements within the Poain platform.

- Daily Yield Distribution: Participants are rewarded daily, which has formed an unchanging stream of income regardless of the price fluctuations of TON.

- Risk Mitigation: The strategy will remove exposure to price volatility in the short-term, as earnings are pegged to yields in stable coins, and also enable investors to accumulate returns even during sideways or down markets.

This system boosts portfolio efficiencies through the combination of liquidity and income generating with the traditional crypto holdings.

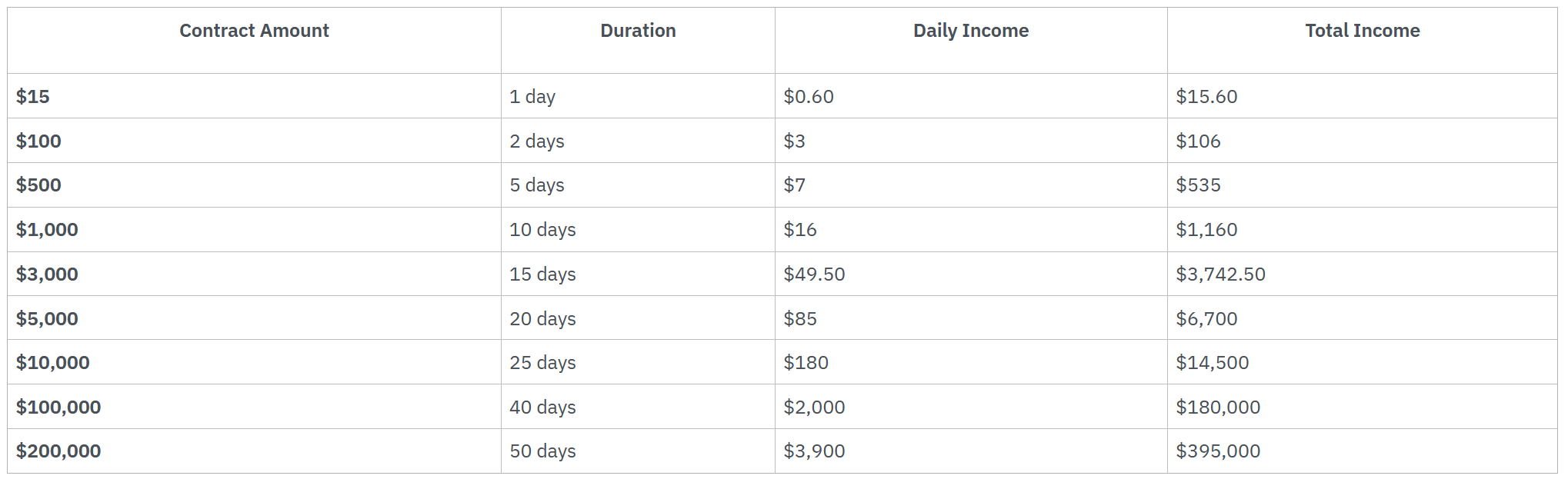

Profit Ratio of the Company and Financial Motives

The Poain platform provides systematic profit ratios based on the terms that can be chosen in relation to the stablecoin contracts. Compounded yields can be used to help the participants earn a stable profile of returns, depending on the selected period of locking and the amount deposited. These profit ratios will be made to compensate longer commitment and volume of stake towards facilitating the disciplined investment strategies.

Since returns are pegged to the performance of smart contracts, and not the price fluctuations of assets, it is possible that users can realize a stable increase in the holdings of stablecoins even when TON or other crypto assets are in the sideways pricing

Example Contract Structure

Registration Bonus: $115 Incentive.

To facilitate the onboarding, as well as promote a wider audience, Poain now provides a registration bonus of $115 USD, which new accounts receive once they have successfully signed in. This incentive allows parties to generate yields without the need to make a considerable investment since it offers an immediate capital infusion to start working with staking stablecoin contracts. The incentive follows the goal of Poain to reduce entry barriers and encourage long-term use of decentralized finance mechanisms.

Tips on Investment Strategies.

In the market dynamics of late 2025 and the entry into 2026, there is a convergence of both consolidation and selective growth potential in the market of Toncoin. It has been predicted that with moderate market improvement conditions TON might experience higher price levels than it is currently valued at by the close of 2026, though price performance is dependent on macro conditions and uptake rates of the ecosystem.

To investors who focus on consistent returns, rather than reward speculative price gains, Poain staking stablecoin contracts have a complementary effect of earning yield without exposing the portfolio

Company name: Poain BlockEnergy Inc.

Website: https://poaintoken.com

Email: marketing1@poain.com

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital.

All market analysis and token data are for informational purposes only and do not constitute financial advice. Readers should conduct independent research and consult licensed advisors before investing.

Crypto Press Release Distribution by BTCPressWire.com