Cambridge, Massachusetts-based Biogen Inc. (BIIB) discovers, develops, manufactures, and delivers therapies for treating neurological and neurodegenerative diseases. Valued at a market cap of $26.2 billion, the company is scheduled to announce its fiscal Q4 earnings for 2025 in the near future.

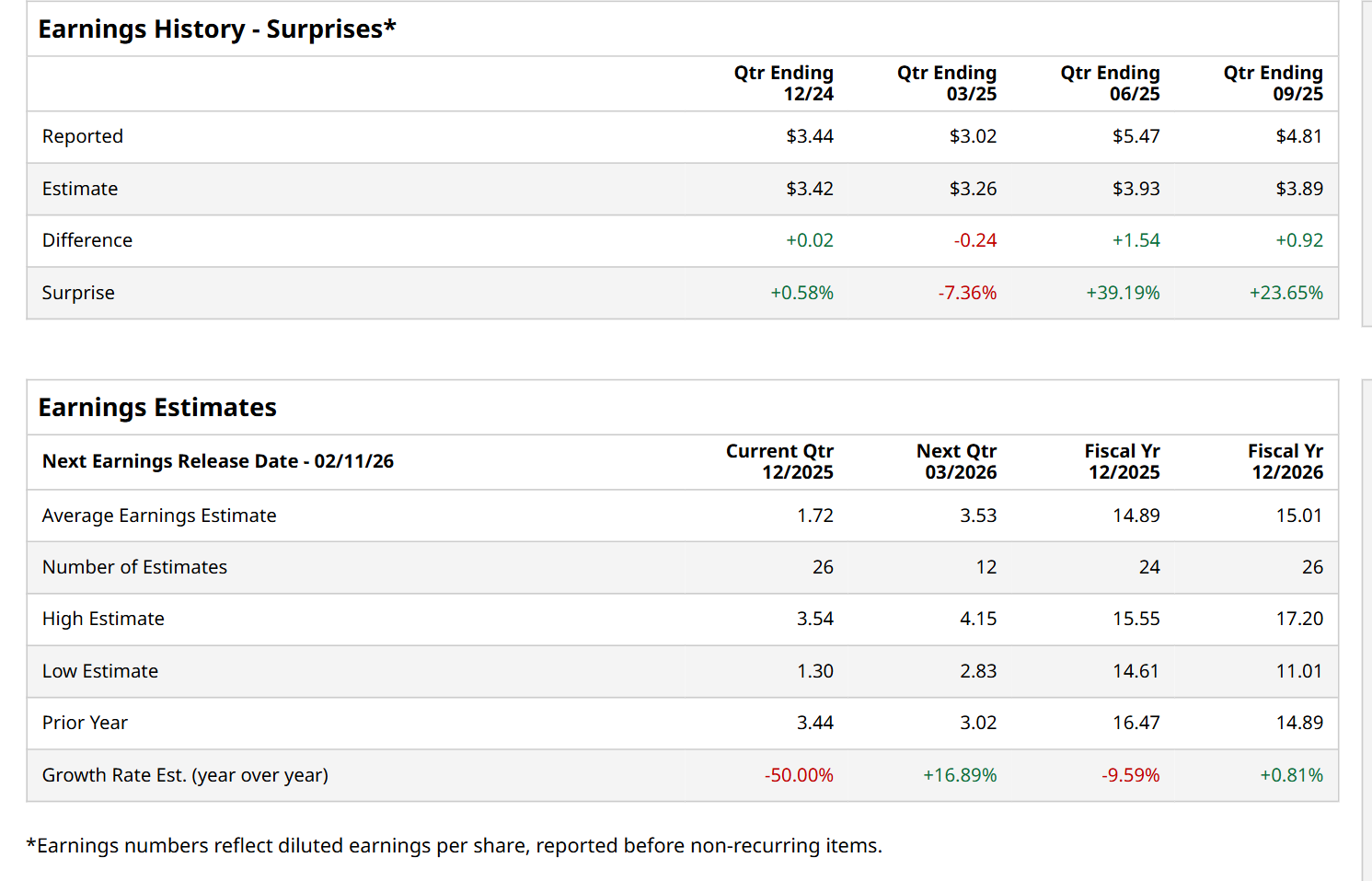

Ahead of this event, analysts expect this healthcare company to report a profit of $1.72 per share, down 50% from $3.44 per share in the year-ago quarter. The company has topped Wall Street’s bottom-line estimates in three of the last four quarters, while missing on another occasion. In Q3, its EPS of $4.81 exceeded the consensus estimates by a notable margin of 23.7%.

For the current fiscal year, ending in December, analysts expect BIIB to report a profit of $14.89 per share, down 9.6% from $16.47 per share in fiscal 2024. Nonetheless, its EPS is expected to rebound and grow marginally year-over-year to $15.01 in fiscal 2026.

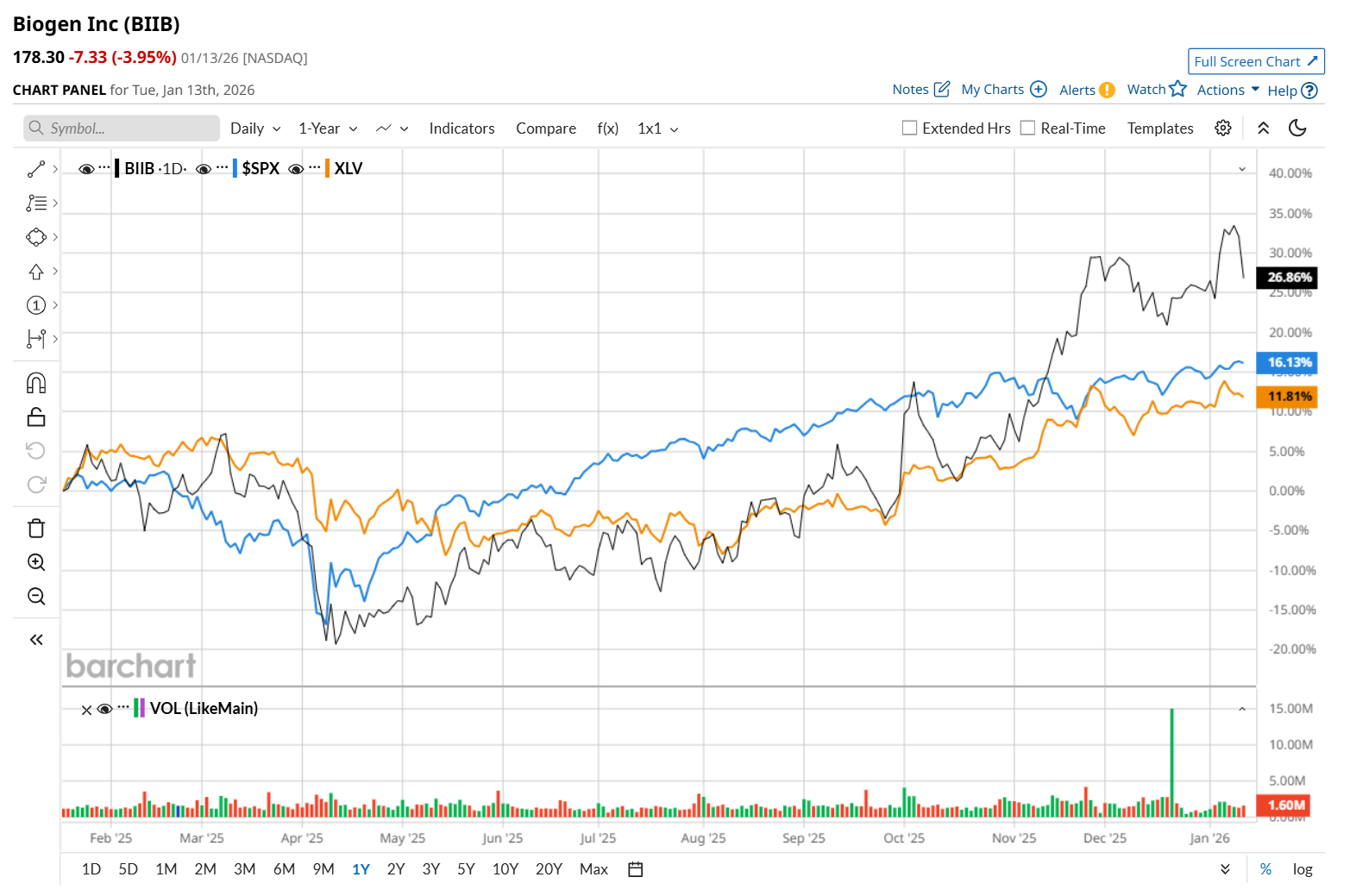

Biogen has lagged behind the S&P 500 Index's ($SPX) 19.7% return over the past 52 weeks, with its shares up 18.7%. However, it has outpaced the State Street Health Care Select Sector SPDR ETF’s (XLV) 10.8% uptick over the same time period.

On Dec. 19, shares of Biogen rose 2.9% after RBC Capital reaffirmed its “Outperform” rating and maintained a $210 price target, naming the stock a top large-cap pick for 2026. The firm pointed to signs of stabilization in Biogen’s core business and projected continued growth of its Alzheimer’s treatment Leqembi over the coming year, reinforcing its optimistic outlook on the company’s overall trajectory.

Wall Street analysts are moderately optimistic about BIIB’s stock, with a "Moderate Buy" rating overall. Among 34 analysts covering the stock, 14 recommend "Strong Buy," one indicates a "Moderate Buy," and 19 suggest "Hold.” The mean price target for BIIB is $187.11, indicating a 4.9% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Should You Buy, Sell, or Hold Visa Stock for January 2026?

- Trump Just Juiced the Bull Case for Lockheed Martin to $1.5 Trillion. Does That Make LMT Stock a Buy Here?

- A $2.65 Billion Reason to Buy Bloom Energy Stock in January 2026

- This 1 Greenland Stock Has Surged in the Past Month. Should You Chase the Rally Here?