Advanced Micro Devices (AMD) is a leading global semiconductor company specializing in high-performance computing and graphics solutions. Renowned for innovation, AMD has accelerated its presence in cloud computing and AI while maintaining strong competition with industry rivals like Intel (INTC) and Nvidia (NVDA). AMD designs and sells CPUs, GPUs, and adaptive solutions for desktops, laptops, gaming consoles, data centers, and AI applications. Its key product lines include Ryzen processors, Radeon graphics cards, and EPYC server chips.

Established in 1969, it is headquartered in Santa Clara, California.

AMD Stock Surges

Advanced Micro Devices' stock has climbed sharply in recent months, rising 14% over the last five days and gaining nearly 57% in the past year. The one-month return was a robust 62%, while the six-month gain surpassed 172%, driven by strategic partnerships and strong demand for AI chips.

This impressive run has outpaced the S&P 500 ($SPX), which posted about 18.33% annual growth in the same period. AMD surged on targeted innovation and OpenAI collaboration, consistently outperforming the broader index and its semiconductor peers.

AMD Reported Mixed Results

Advanced Micro Devices reported Q2 2025 on Aug. 5, with a revenue of $7.7 billion, beating analyst estimates of $7.41 billion and representing a 32% year-over-year (YoY) increase. However, EPS came in at $0.48, missing expectations by $0.06 due to a significant $800 million inventory and related charge linked to U.S. export controls on AMD Instinct MI308 GPUs. The company’s data center and client processor segments fueled the topline beat, with strong demand for Ryzen and EPYC products driving record sales.

Despite impressive revenue growth, profitability was pressured by those inventory-related charges. Operating income reached $897 million, but margins shrank to 43% from 53% the prior year, or an estimated 54% had the MI308 charge been excluded. The company’s free cash flow exceeded $1 billion, and it ended the quarter with $5.9 billion in cash and equivalents. AMD also repurchased $478 million in stock during Q2, continuing active shareholder return efforts.

For Q3 2025, AMD guided revenue to be around $8.7 billion, indicating approximately 13% sequential growth and a 28% YoY improvement at the midpoint. Management expects non-GAAP gross margin to recover to 54% as MI350 accelerator shipments ramp, while highlighting robust demand in AI and core computing segments and reiterating caution around ongoing export restrictions.

AMD is also set to release its third-quarter results on Nov. 4.

Positive Talk From Analyst

Ahead of its Q3 results, top Rosenblatt Securities analyst Kevin Cassidy has reiterated his “Buy” rating, with a $250 price target, reflecting a 3% downside based on AMD's pre-earnings price movement. Cassidy cites anticipated strong demand in PC and server chips and ongoing market-share gains as catalysts for a modest beat-and-raise quarter.

Investor focus is increasingly turning to upcoming updates, notably on AMD's Instinct GPUs, the ROCm software stack, and the new Helios rack-scale platform, key elements of its AI-driven data center strategy. Cassidy expects management’s tone to remain upbeat due to tailwinds in AI and servers and believes continued innovation in these areas will be a highlight during the Q3 earnings call and upcoming Analyst Day event on Nov. 11.

Cassidy believes steady execution in AI and server chips, along with positive management commentary, could move the stock higher post-earnings. Further product details and strategic announcements at Analyst Day may act as near-term catalysts for the stock.

Should You Bet on AMD?

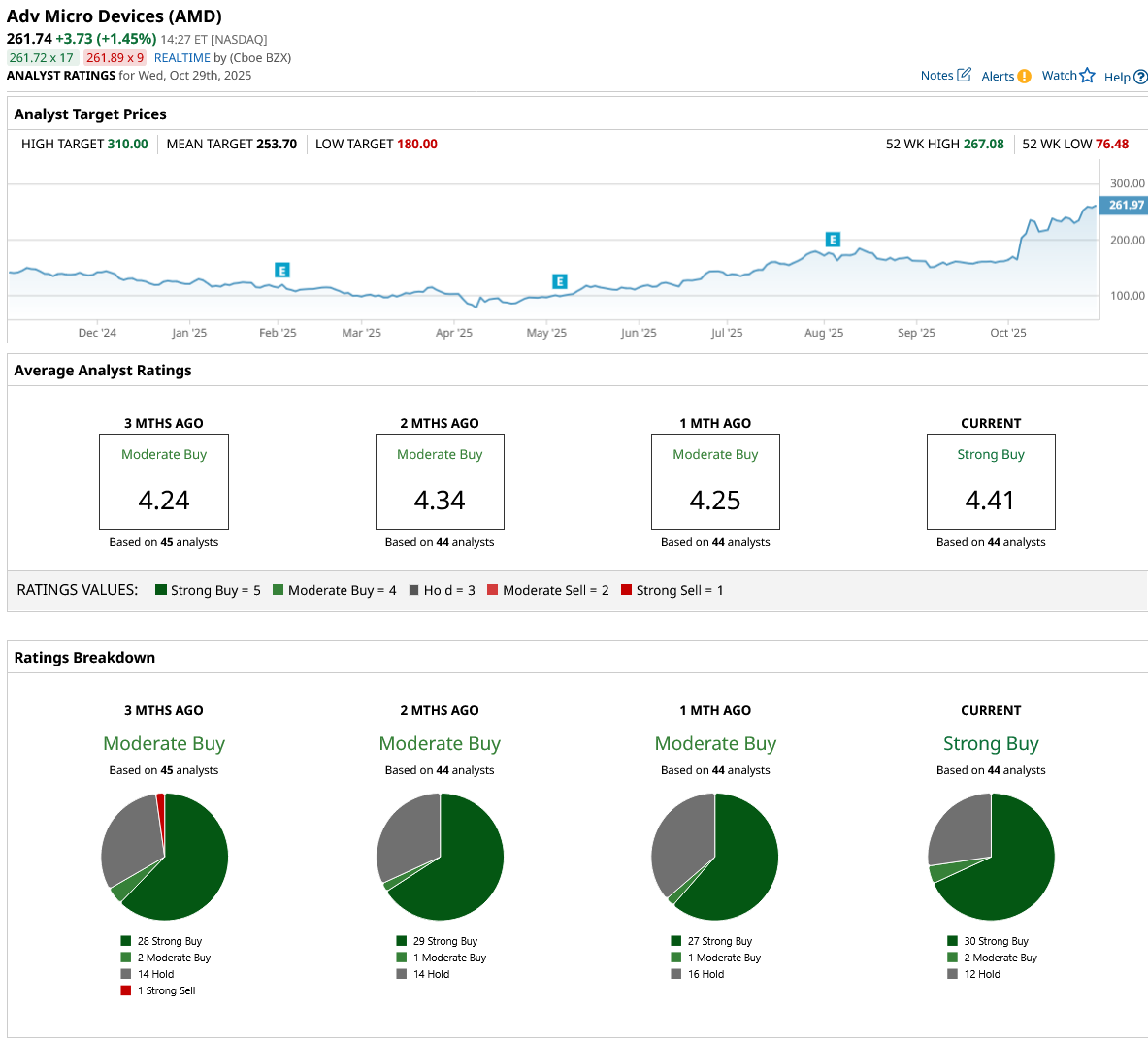

Ahead of its quarterly results, AMD stock has a consensus “Strong Buy” rating from analysts. However, despite the strong rating, the stock’s mean price target of $253.70 reflects a slight downside of 1.6% from the market rate, as analysts still play catch-up after AMD’s strong performance this month.

AMD stock has been rated 44 times by analysts, receiving 30 “Strong Buy” ratings, two “Moderate Buy” ratings, and 12 “Hold” ratings.

On the date of publication, Ruchi Gupta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart